Holding Institution

Document ID

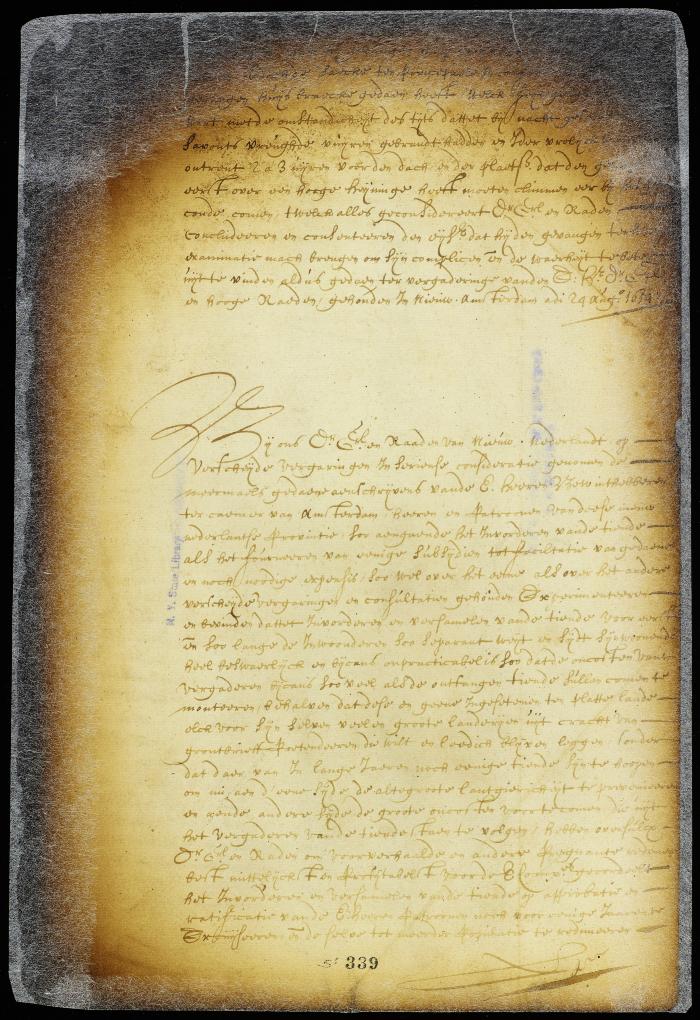

NYSA_A1809-78_V05_0339

Description

Resolution. Postponing the collection of tenths and imposing a tax on horned cattle and land.

Document Date

1654-08-24

Document Date (Date Type)

1654-08-24

Document Type

Document Type Unlinked

Resolution

Full Resolution Image

A1809 Additional Party